| February 13th, 2020 |

Use of Payment Gateway & Merchant Account in E-commerce

E-commerce market boom is perfectly in sync with the penetration of internet and technology in our lifestyles. The conventional brick and mortar store days are well behind us. Consumers and marketplaces now meet on the internet and every second hundreds of thousands of transactions take place via different online payment systems. A study expects that 2020 will witness an estimated total of 726 billion digital transactions worldwide.

As digital modes of payment grew, a mechanism to securely process these payments and store relevant information was put in place. If you are a small or medium sized business owner, or even a big player too and you have taken your business online, you would find these terms familiar, but if you are still hitting the old conventional ways and counting currency notes and maintaining ledger books, you definitely need to up your game.

Any payment process involves three parties mainly:

The customer, who pays,

The merchant, who receives and

The medium, one who facilitates the transaction (if any).

However, more players can come in to facilitate the process, also adding security and reliability.

These players fulfill the need of a merchant account or a payment gateway or both as per the requirements of the business/service allowing a business to accept different modes of payment.

What is a Merchant Account?

A merchant account allows your e-commerce set-up to accept credit/debit card payments online. It is simply a holding place for your money until it is transferred to the business account after transactions are authorized. Generally, money remains for 2-7 days in a merchant account to facilitate refunds in case of return or cancellation of a purchase. A merchant account holds funds from several transactions and makes consolidated payments to the merchant’s business account.

A merchant account is basically a license which permits a business to accept card payments. It functions round the clock and provides encryption and decryption at both ends. Service providers that help e-businesses set up merchant accounts charge a processing free. A merchant account could be dedicated which gives full control to the merchant or aggregated which is shared between multiple businesses.

What is a Payment Gateway?

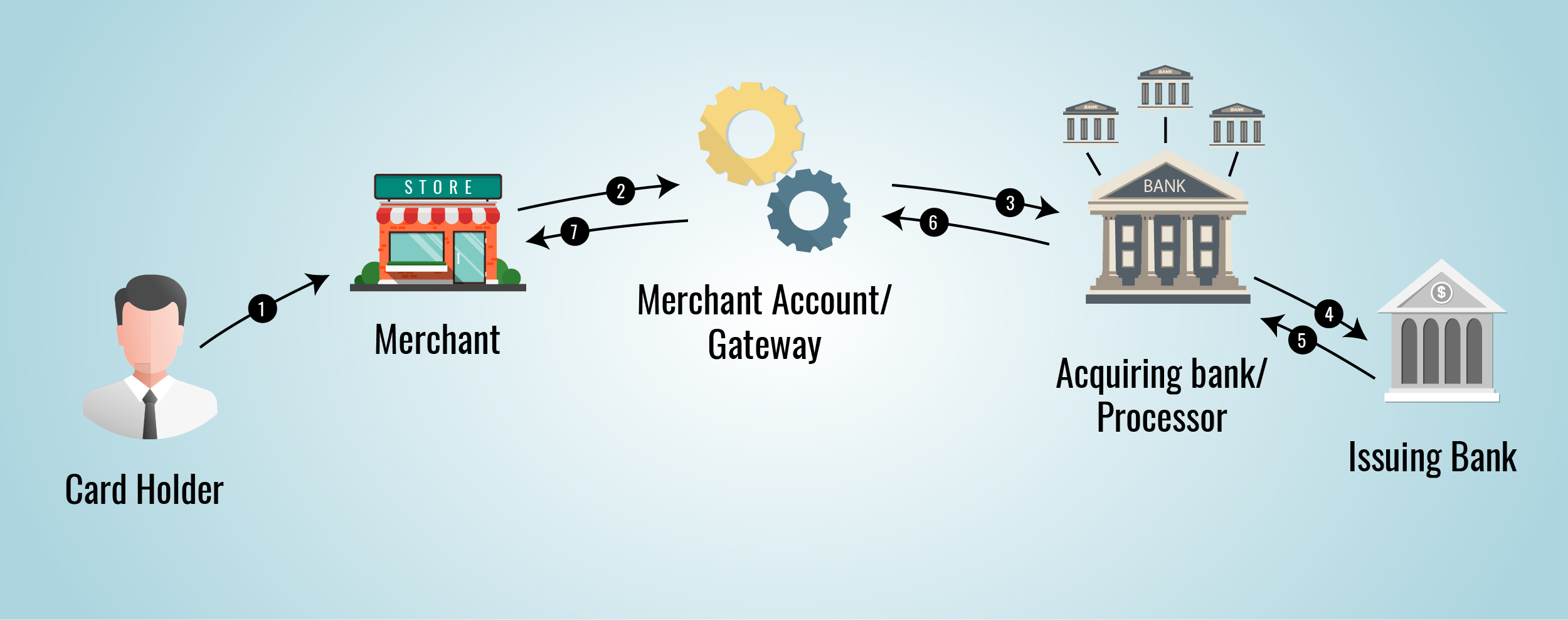

A payment gateway is the medium or means of receiving online payments (including credit cards). Without a payment gateway a merchant account is useless. Payment gateways establish secure communication between the parties involved. A payment gateway usually sends the customer off-site and may sometimes lead to reduction in conversions. A payment processor provides the necessary communication between the merchant, bank and payment gateway, thus facilitating the whole process. A gateway also establishes checkpoints where it validates the transaction with all parties involved.

Difference Between Merchant Account and Payment Gateway:

Both are technically different but are used to achieve a common goal, i.e. fast, secure and smooth transactions. While a merchant account makes your business capable of receiving credit/debit card payments, a payment gateway provides the path through which this transaction can be completed.

Both a payment gateway and a merchant account provide for complete automation of digital transactions. They both are essential to provide a secure, affordable and seamless online payment system to the consumer as well as to the business owners.

The needs of your business can be fulfilled only by using a payment gateway for starters but if you plan on expansion and higher volumes of e-commerce, then you should start looking for a company that provides reliable merchant account and payment gateway services. E-commerce, m-commerce have completely overshadowed the conventional shops and the need for faster, secure and seamless financial transactions is something a business can not simply run without.

With payments made easy, focus can be targeted towards growing and expanding the business. We hope this clears any confusion between a payment gateway and a merchant account and why both of them are needed.

Our experts are here to help you. For any comments, remarks or queries, please write to us!