| May 22nd, 2023 |

Driving Global Expansion: Exploring Cross-Border eCheck Transactions!

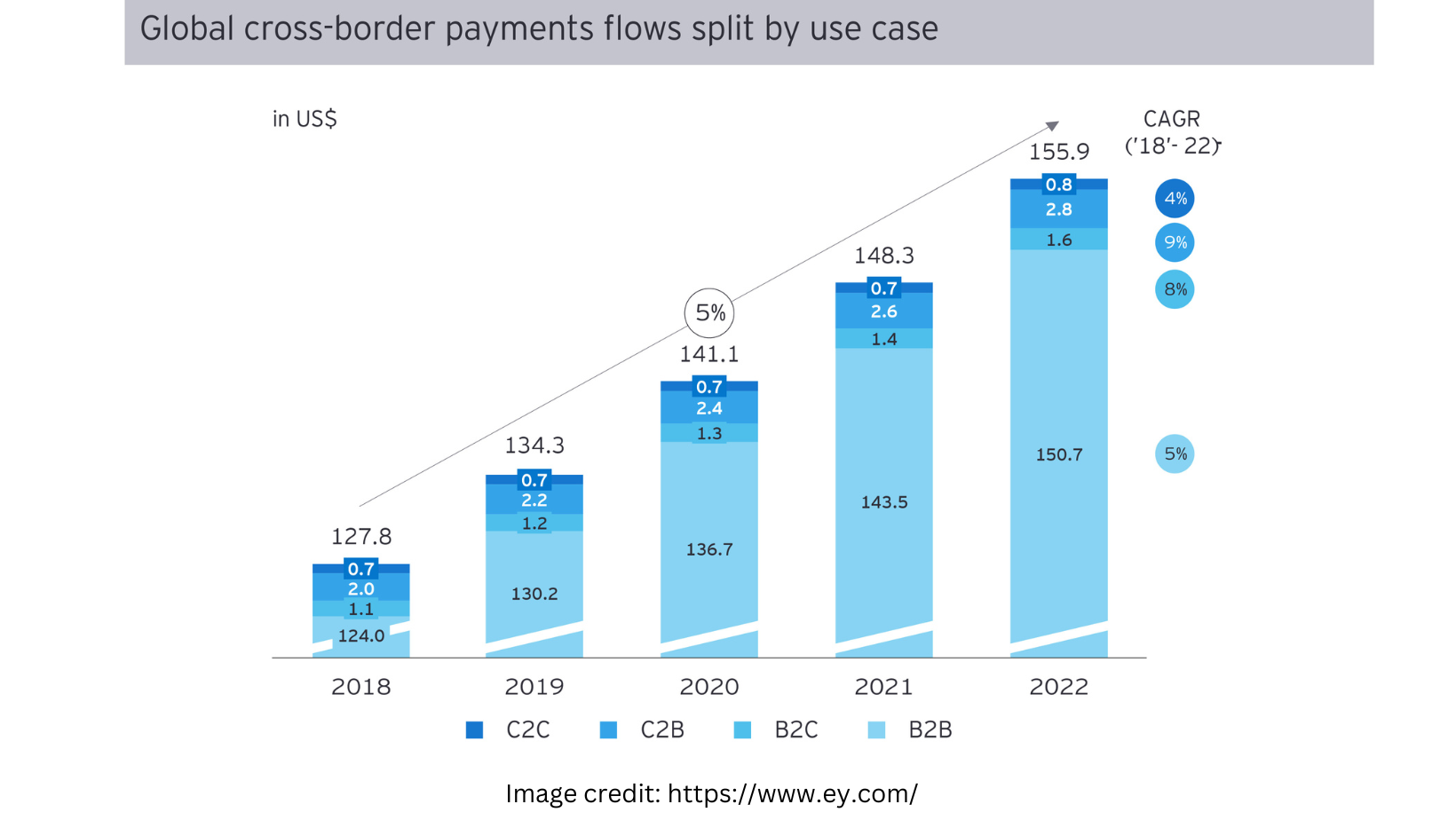

Businesses are constantly looking to expand their operations globally, in today’s interconnected world. Cross-border payment solutions have become an important factor in driving this global expansion, with the rise of e-commerce and online transactions. Cross-border eCheck transactions are one such solution that is gaining popularity. Let’s delve into the concept of eChecks, explore their benefits, and understand how they can facilitate seamless cross-border transactions for businesses.

Understanding eCheck:

eCheck or an electronic check is a digital version of a regular paper check that is accepted and a safe way of transferring funds online. Funds can be transferred easily with eChecks from a payer’s bank account to the payee’s account. It minimizes the time and costs associated with traditional check processing.

The Advantages of eCheck for Cross-Border Transactions:

Cost-Effective:

Cost-effectiveness is one of the most important advantages of eChecks for cross-border transactions. It offers minimum transaction fees, which makes it an attractive option for businesses expanding globally. Reduced costs allow businesses to allocate resources more efficiently and invest in other areas of growth.

Security and Fraud Prevention:

eChecks implements advanced security measures ensuring the safety of transactions. With digital encryption technology, sensitive information is protected, and the risk of fraud is reduced. Electronic verification processes reduce data entry errors, enhancing the overall security of cross-border transactions.

Faster Processing Times:

Echecks offer faster processing time as opposed to traditional checks that could take days or weeks to clear. Cross-border eChecks are processed smoothly, allowing businesses to receive funds faster and more efficiently, with automated clearing and settlement systems. This feature is particularly beneficial for companies engaged in time-sensitive operations.

Wide Acceptance and Accessibility:

eChecks are accepted globally, making it a convenient method of payment for cross-border transactions. eCheck transactions are supported and recognized by financial institutions and payment processors. It offers businesses a broad network for conducting international business operations. The wide acceptance of eChecks eliminates barriers and simplifies the payment process across borders.

Streamlined Integration:

Integrating eCheck payment solutions into existing payment systems is relatively straightforward. Many payment gateways and platforms offer seamless integration options, allowing businesses to adopt eChecks without significant disruptions to their existing operations. This streamlined integration further enhances the appeal of eChecks for global expansion.

Considerations for Successful Cross-Border eCheck Transactions:

While eChecks offers numerous advantages for cross-border transactions, businesses should consider the following factors to ensure successful implementation:

Compliance and Regulatory Requirements:

Different countries have varying regulations and compliance requirements concerning cross-border transactions. Businesses must thoroughly research and understand the legal and regulatory landscape of target markets to ensure compliance with local laws. Engaging legal and financial experts can help navigate these complexities.

Currency Conversion and Exchange Rates:

When conducting cross-border eCheck transactions, businesses need to account for currency conversion and exchange rates. Fluctuations in exchange rates can impact transaction values and overall profitability. Utilizing currency conversion services or consulting with currency experts can help mitigate these risks.

Communication and Language Considerations:

Effective communication is crucial when conducting cross-border transactions. Ensure that your business can effectively communicate with customers, partners, and financial institutions in the respective countries. Language barriers and cultural differences should be considered and addressed appropriately to avoid any misunderstandings or delays.

Conclusion:

As businesses strive for global expansion, cross-border eCheck transactions offer a secure, cost-effective, and efficient solution for facilitating international payments. With their numerous benefits, including lower costs, enhanced security, faster processing times, and wide acceptance.