| June 2nd, 2022 |

Gain An Insight To Know How ACH Payment Processing Works For Small Businesses?

Have you ever thought about whether small businesses reap benefits from ACH payments? If you believe, ACH payments work as a potential payment solution for several companies.

ACH (Automated Clearing House) payments are undoubtedly the best payment method that has gained popularity; this fact is supported by NACHA, which reported a 9 percent increase in payments across the ACH network in 2020 compared to 2019.

But, do you ever wonder how ACH payments can help your small business? There are many ways ACH payment technology can get implemented into a business, irrespective of whether it remains big or small. It gives benefits to both customers and businesses.

Do you wonder how ACH payments work?

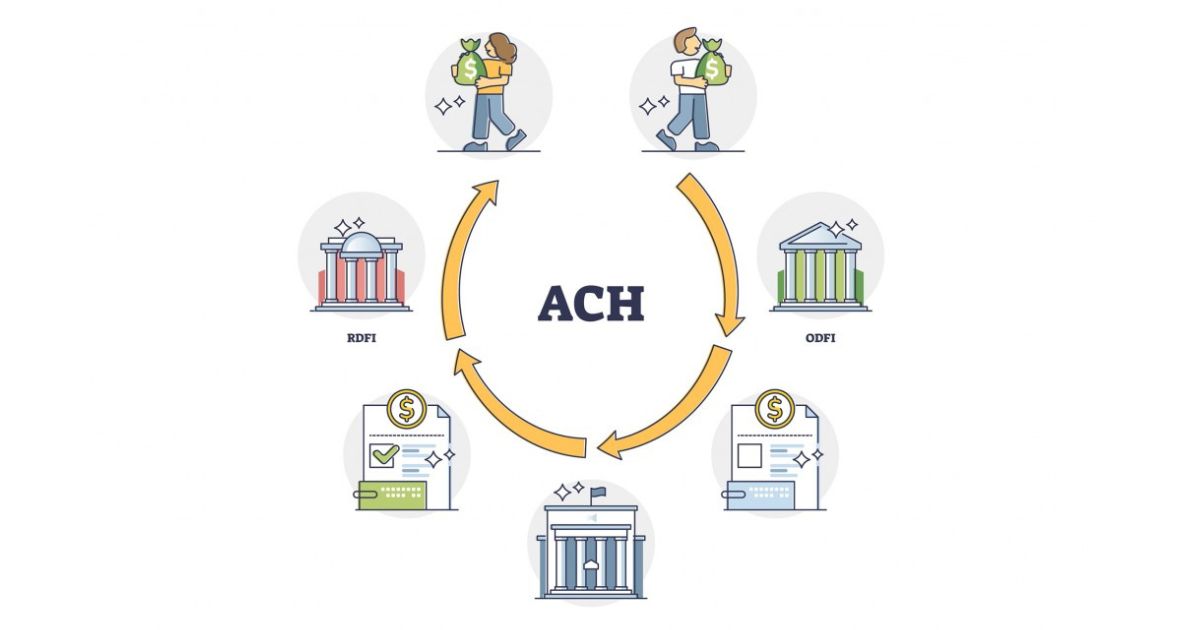

ACH payment processing happens electronically, enabling a bank transfer between the payer’s and payee’s bank accounts through the Automated Clearing House Network of U.S. financial institutions, which Nacha governs.

ACH payment processing is used for recurring and one-time payments instead of paper checks, wire transfers, credit cards, or debit card payment methods.

ACH payments are usually made by direct transfer of funds from one bank to another, which implies that businesses and customers can send funds for regular payments through the ACH payment network. It removes the use of physical debit and credit cards, including paper checks.

ACH payments can be processed through the Automated Clearing House Network and are usually taken by large businesses that pay for their employees and facilitate transfers between institutions. However, they have also labeled a functional payment solution for small businesses that rely on the secure and modern alternative to support traditional check or card payments.

The ACH Network works as an electronic system that serves more than 10,000 financial institutions to facilitate financial transactions in the United States. In addition, the ACH Network usually acts as a delivery mechanism that allows people and organizations to move money from one bank account to another.

ACH transactions consist of direct deposits and direct payments, including business-to-business (B2B) transactions, government transactions, and consumer transactions.

Read Four Ways Through Which ACH Payments Can Help Small Businesses To Grow –

The primary consideration for any business is how each payment method can turn out to benefit them.

When it comes to ACH payments, there are several ways through which they can be integrated into processes and turn into a valuable addition to their payment options.

1. Receiving Customer Payments:

Merchants need to allow their customers to authorize their transactions to transfer funds from their bank accounts to yours; this is the foremost step for receiving the ACH transactions.

Thus, ACH payments are labeled to be much quicker and easier. Moreover, it offers customers more chances with a more secure way of paying through the traditional paper check comprising all the benefits necessary for a contactless world.

2. Eliminate Card Brand Fees:

If a merchant receives ACH payments from their customers, it might be more cost-effective than card payments. This is because the credit card processing payment also charges fees for processing payments for using their card network.

Thus, it can be said that by allowing your customers to pay by using their banking information, one can easily avoid incurring card-based fees. Each transaction may seem insignificant, but the savings become substantial when a significant volume of payments gets made this way.

3. Paying Suppliers:

If you are a small business owner, who needs to pay suppliers regularly, then accepting the payments through online mode can be beneficial. Thus, you should give preference to ACH payments which work as an ideal way of processing these transactions.

ACH payments work as a safe and convenient mode of transferring money from one bank account to another. As the threat of fraud has been drastically diminished, small businesses can pay suppliers without worrying about losing money or even experiencing the inconvenience of using paper checks.

4. Paying Taxes:

The ACH payments help merchants easily make payments when it comes to paying tax payments. Thus, it is assumed that ACH payments help in streamlining the tax payments.

5. Paying Employees:

Many large businesses prefer ACH payments to pay their employees, and small businesses use these payments. Small businesses need to set up payment instruction that uses the recipient’s bank routing and account number. It also consists of necessary authorization from their bank.

Conclusion:

ACH payments are labeled the most cost-effective payment option that helps merchants save their processing fees. Unlike a paper check, an ACH payment can be paid online, which helps reduce the processing time.

ACH payments are also preferred over paper checks, which implies that banks will usually process an ACH payment before a paper check. Moreover, these features ensure that merchants can get funds faster than traditional checks.