| March 28th, 2023 |

THE IMPACT OF DIGITAL PAYMENTS ON BUSINESSES

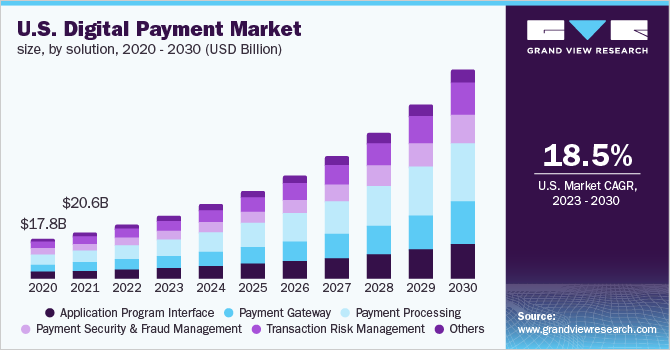

The impact of digital payments on businesses has been significant in recent years. With the proliferation of smartphones and the rise of online shopping, digital payment methods such as credit card payments, mobile payments, and electronic fund transfers have become increasingly popular

One of the main benefits of digital payments for businesses is the increase in efficiency. Traditional payment methods such as cash and check can be time-consuming and prone to errors, whereas digital payments can be processed almost instantly. This can save businesses a lot of time and resources, especially for businesses that process a large volume of transactions. We have many options that are in the market for easier transactions, one of which is the electronic check (also known as echeck payment or echeck) which is an electronic version of a check. These are available to be used by merchant accounts as well as customer accounts, especially for bigger sums of money.

Digital payments also provide businesses with a more secure payment option. Traditional payment methods such as cash can be lost or stolen, whereas digital payments are typically encrypted and secure. This can reduce the risk of fraud and financial loss for businesses.

Another benefit of digital payments is the ability to track and analyze data. With digital payment systems, businesses can gather detailed data on customer spending patterns and preferences. This can be valuable for businesses as they can use this information to improve their products and services, as well as to tailor their marketing efforts to specific customer segments.

By lowering operational expenses and simplifying the management of trade contracts, delivery records, and accounts receivables, switching from cash to digital payments can boost an entrepreneur’s profitability. Making and accepting digital payments may enhance an entrepreneur’s connections with customers, vendors, and financial institutions as well as their participation in e-commerce. Digital records, for instance, may assist business owners in more effectively managing their inventory supplies and choosing more affordable suppliers. Small business owners, for instance, can monitor their sales by product category and day of the week and utilize this data to improve inventory control. By minimizing the accrued interest on supplier loans, business owners may make digital payments to suppliers more often, reducing the number of days of extended trade credit and working capital costs.

By leaving a clear electronic trail that can be followed, digital financial payments also make record-keeping easier and increase transparency while lowering document-related fraud. Businesses that accept digital payments have less cash on hand, which reduces the danger of theft. Digital payments might be particularly crucial for female businesses’ success. Women frequently find it difficult to go to distant suppliers or bank offices due to societal standards, long travel distances, and family obligations. They can overcome these mobility restrictions thanks to digital payments, which make it simpler for them to access money and the market.

Overall, the impact of digital payments on businesses has been largely positive. They have increased efficiency, provided a more secure payment option, and given businesses the ability to track and analyze customer data. As digital payment technology continues to evolve, it is likely that the use of digital payments will continue to grow, further transforming the way businesses operate.